NOVEDADES

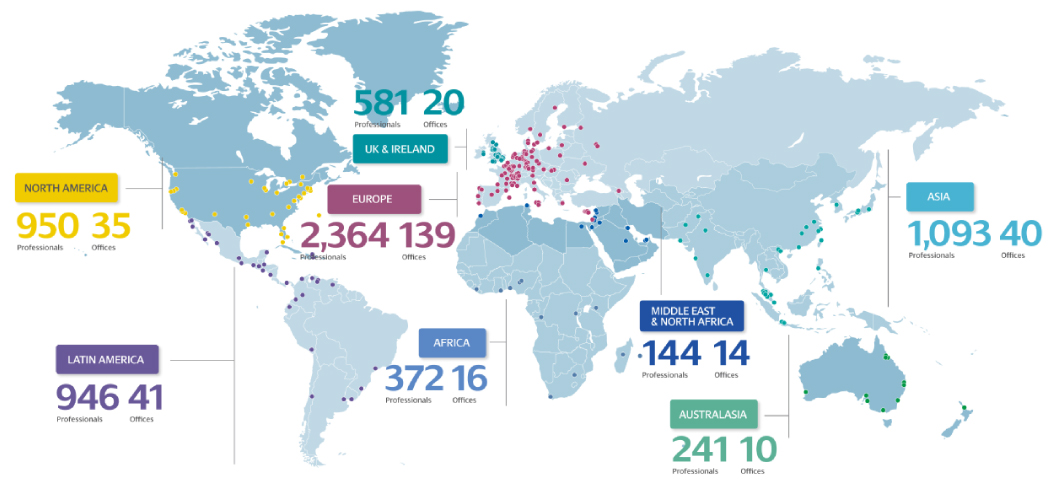

MGI en el mundo

Por más información visite www.mgiworld.com

MGI Worldwide is a network of independent audit, tax, accounting and consulting firms. MGI Worldwide does not provide any services and its member firms are not an international partnership. Each member firm is a separate entity and neither MGI Worldwide nor any member firm accepts responsibility for the activities, work, opinions or services of any other member firm. For more information visit www.mgiworld.com/legal

Nuestra firma

Desde 1997

Somos una firma de profesionales con más de 20 años de experiencia en nuestro mercado y en el mercado internacional a través de nuestra red global MGI Worldwide: una de las principales redes mundiales de contadores y auditores con 70 años de trayectoria, presencia en más de 80 países y acceso a 5000 profesionales. Trabajamos de la mano de nuestros clientes para ofrecer un servicio de excelencia, con soluciones a medida, a través de una atención personalizada.

Ofrecemos soporte profesional integral, desde el inicio del proyecto, buscando optimizar la inversión y maximizar la confianza en cada etapa del proceso de crecimiento, con el objetivo puesto en el éxito a largo plazo. Nos gusta ser una empresa dinámica: estamos siempre atentos a las últimas tendencias, apostando a la actualización de conocimientos e incorporando la más avanzada tecnología.

DATOS DE INTERÉS

REPÚBLICA DOMINICANA

República Dominicana es un país de mediano ingreso con una de las economías más grandes de América Central y el Caribe. Ocupa la parte oriental de la isla de la Hispaniola, ubicada en la Antillas, con una superficie de 48,311 KM2 aproximadamente. El Tratado de Libre Comercio entre Estados Unidos, Centro América y República Dominicana (DR-CAFTA) se hizo efectivo en marzo de 2007. Este tratado les brinda a las naciones aliadas la ventaja de tener acceso permanente y totalmente abierto al mercado de Estados Unidos, con lo cual se busca atraer a la región a más inversionistas.

Población: 10.4 millones hab.

Sectores Económicos Principales: Servicios, Comercio, Manufactura, Zona Franca, Telecomunicaciones, Gobierno.

Sectores en desarrollo: Turismo, Agroindustria, Industria Artística y Salud.

FILOSOFÍA

VISION

Ser una empresa líder en el mercado de Consultoría, Auditoría e Impuestos. Entregar a nuestros clientes una atención personalizada y de excelencia, poniendo a su disposición profesionales altamente capacitados junto a la más avanzada tecnología.

MISIÓN

Brindar soporte profesional a nuestros clientes en cada nivel, desde la planificación inicial, identificando y controlando los riesgos, optimizando las inversiones y asegurando confianza en cada etapa del proceso de crecimiento con el objetivo de éxito en los años siguientes.

VALORES

Ética, Honestidad, Justicia, Responsabilidad, Integridad, Trabajo en equipo, Sensibilidad con la comunidad, Espíritu de servicio, Justicia, Austeridad.

EQUIPO

CONSEJO DE ADMINISTRACION

Licdo. Luis F. Taveras Then

Socio Director

25 años de experiencia profesional, Vice-Presidente de la Asociación de Firmas de Auditores Externos de la Republica Dominicana, Gerente de MGI Centro América y el Caribe, Consultor del Banco Interamericano de Desarrollo (BID, Ex presidente del Instituto de Contadores Publico Autorizado de la Republica Dominicana, graduado en Contabilidad en Universidad Autónoma de Santo Domingo (UASD), maestría en alta gerencia, post-grado en impuestos sobre la renta, diplomado en normas internacionales de información financiera y normas internacionales de auditoria, catedrático universitario por mas de diez (10) años, profesor de tesis y maestrías, amplio manejo de las leyes fiscales, conocimiento de ley laboral, seguridad social y nueva ley de sociedades.

Participación de seminarios y entrenamientos técnicos en diversos países del mundo, como son: Estados Unidos, México, Chile, Colombia, Uruguay y Perú; y en el país ha participado en mas de 100 cursos y entrenamientos, así como ha impartido la gran parte de ellos en Republica Dominicana y fuera del país.

Licdo. Domingo Antonio Mones

Socio Oficina Sucursal Santo Domingo

15 años de experiencia profesional, graduado con honores en Contaduría en la Universidad Tecnológica de Santiago, con especialidad en contabilidad impositiva en Universidad Autónoma de Santo Domingo, maestría en administración financiera. Entrenamiento para facilitadores en normas internacionales de información financiera realizado por en la banco mundial, seminario en Argentina de Normas Internacionales de información financiera.

Especialización en auditoria financiera en tres de las firmas más grandes del mundo. Profesor de impuesto y de normas internacionales de información financiera en la universidad APEC, UASD, Escuela nacional de finanzas (ESENFA), Instituto de contadores publico de la República Dominicana. demás, facilitador de diversos talleres de impuesto a nivel corporativo, entre los que se destacan: Grupo Ramos, Odebrecht, Grupo SID y Grupo Maersk. Director técnico del instituto de contadores públicos autorizados de la Republica Dominicana (ICPARD).

Licda. Carla Mariel Rodríguez

Socia-Gerente Financiera

11 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad en la Universidad Católica Nordestana (UCNE) con los honores de Magna Cum Laude, maestría en Contabilidad Tributaria y post-grado en contabilidad de gestión en la Universidad Autónoma de Santo Domingo (UASD).

Dominio de impuestos sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley sociedades), miembro activo instituto de Contadores Públicos Autorizados de la Republica Dominicana, domina el paquete informático Office y el idioma ingles y conocimientos en seguridad social. Miembro de Rotary Internacional. Participación de seminarios y entrenamientos técnicos en diversos países del mundo, como son: Estados Unidos, México, Chile y Colombia.

Licda. Nelcida Berroa

Socia-Gerente de Impuesto

17 años de experiencia profesional, de los cuales trece (13) han sido trabajando en la firma de auditores MGI DOMINICANA, Licenciada en Contabilidad, Postgrado en impuesto sobre la renta, diplomado auditoria interna, diplomado en norma internacionales de contabilidad, conocimiento del paquete informático, participación en mas de 50 cursos, talleres y seminarios, relacionados con la actividad profesional, dominio de impuestos sobre la renta, auditoria fiscal, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento y dominio ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley de sociedades), miembro activo instituto de Contadores Públicos Autorizados dela Republica Dominicana.

Licdo. Ricardo Ruiz Bentancourt

Socio Gerente de Auditoría

Experiencia en planeación estratégica. Mercadeo, visitas a potenciales clientes, elaboración de propuestas. Planeación de los compromisos de trabajo, supervisión y entrenamiento del Personal. Coordinador para América Latina de MGI (www.mgiworld.com).

Coordinador de MGI para América Latina. Esta labor implica la gerencia de la firma regional, cursos, revisiones de calidad, eventos, admisión de nuevos miembros.

Logros: Lidere el proceso para elevar el ranking de la firma en Venezuela mediante el desarrollo de metodología, staff profesional y organización. Dirigí procesos para la mejora de la gerencia de proyectos, facturación, servicio al cliente, desarrollo de negocios y entrenamiento del personal profesional, logrando un pico de facturación de U$ 1.200.000. Coordinación del área latinoamericana de MGI (www.mgiworld.com). Participe en el proceso de implantación y mejora de los sistemas de control de calidad de MGI. Aumente la eficiencia y eficacia de la auditoria, reduciendo el tiempo de ejecución entre un 20%/30%. Gerente de Auditoría, Planeación y supervisión de los diferentes compromisos, elaboración de propuestas, instructor de cursos de entrenamiento internos y externos.

Licda. Ginelcy Paulino Berroa

Socio Gerente de Auditoría

11 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad en la Universidad Autónoma de Santo Domingo (UASD) con los honores de Cum Laude, actualmente cursando maestría en Auditoría Interna en la Universidad Autónoma de Santo Domingo (UASD).

Dominio de impuestos sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley sociedades), miembro activo instituto de Contadores Públicos Autorizados de la Republica Dominicana, domina el paquete informático Office y el idioma ingles y conocimientos en seguridad social. Participación de seminarios y entrenamientos técnicos en diversos países del mundo, como son: , Argentina, Chile.

DEPARTAMENTO DE AUDITORIA

Licda. Ginelcy Paulino Berroa

Gerente Departamento de Auditoría

Más de 11 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad en la Universidad Autónoma de Santo Domingo (UASD) con los honores de Cum Laude, actualmente cursando maestría en Auditoría Interna en la Universidad Autónoma de Santo Domingo (UASD).

Dominio de impuestos sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley sociedades), miembro activo instituto de Contadores Públicos Autorizados de la Republica Dominicana, domina el paquete informático Office y el idioma ingles y conocimientos en seguridad social. Participación de seminarios y entrenamientos técnicos en diversos países del mundo, como son: , Argentina, Chile.

Licda. Sidney Vargas

Supervisora Departamento de Auditoría

Experiencia profesional desde el año 2018. Graduada en la Licenciatura de Contabilidad en la Universidad Católica Nordestana (UCNE). Maestría en Contabilidad Tributaria en la Universidad Autónoma de Santo Domingo (UASD) y cursando la Maestría en Auditoria Interna en la Universidad Autónoma de Santo Domingo (UASD).

Con conocimientos en contabilidad financiera y tributaria, Ley de Seguridad Social, Ley Laboral y auditoria. Dominio del paquete informático Office y el idioma inglés. Miembro activo del Instituto de Contadores Públicos Autorizados de la República Dominicana (ICPARD). Ha realizado diversos cursos, conferencias y diplomados de Contabilidad Financiera y Fiscales, Tesorería de Seguridad Social (TSS), Auditoria y Mandos Medios.

Licda. Isianny Mendoza Hernández

Auxiliar de Auditoría

4 años de experiencia en el área, graduada de la carrera de Licenciatura de contabilidad en la Universidad Católica Nordestana (UCNE).

Conocimiento básico de contabilidad financiera, además de la participación de 11 curso-taller impartidos por el INFOTEP, para reforzamiento de los conocimientos técnicos como son: servicio al cliente, secretariado ejecutivo, manejo básico de Excel, entre otros; y 5 de otros centros de capacitaciones entre los cuales están: riesgo operacional, diplomado de contabilidad por igualas, impartido por EDUTEC. Conocimiento y manejo del paquete de Office, habilidades para trabajar en equipo, sentido de compromiso y comunicación.

Srta. Diomary Eunice Alfau

Auxiliar de Auditoría

Estudiante de término de la Licenciatura de Contabilidad en la UASD, Recinto San Francisco de Macorís, con 2 años de experiencia laboral en la Firma de Auditores MGI Dominicana.

Participación en 5 curso impartido por Infotep: Marketing Personal, Inteligencia Emocional, Auxiliar de Contabilidad, Manejador de Contabilidad Fiscal, Servicio al Cliente, al igual que numerosos talleres dados en la Firma.

Habilidades para trabajar en colaboración con otros, responsable y dedicada en los trabajos desempeñados.

Licda. Fior D Aliza Rodríguez

Auxiliar de Auditoría

1 años de experiencia laboral en la Firma de Auditores MGI Dominicana. Graduada de la carrera de Licenciatura de Contabilidad en la UASD, Recinto San Francisco de Macorís.

Participación en 7 curso impartido por Infotep: Auxiliar De Contabilidad, Relaciones Humanas, Manejador De Inventario, Manejador De Contabilidad Fiscal, Liderazgo, Manejo Básico Del Computador, Secretariado Ejecutivo, al igual que numerosos talleres dados en la Firma.

Sra. Rossary Jamilette Rosa Medina

Auxiliar de Auditoría

Estudiante de término de la Licenciatura de Contabilidad en la UASD, Recinto San Francisco de Macorís, con 6 meses de experiencia laboral en MGI LT Accountant y Asociados. Participación en 2 curso impartido por UDEMY: Manejo Básico del paquete de Office (Word, Excel, Power Point), Manejo Básico del Computador. Habilidad para trabajar en equipo, se destaca por su responsabilidad, compromiso y capacidad de trabajo en equipo.

DEPARTAMENTO DE IMPUESTOS Y OUTSOURCING

Licda. Nelcida Berroa

Socia-Gerente de Impuesto

17 años de experiencia profesional, de los cuales trece (13) han sido trabajando en la firma de auditores MGI DOMINICANA, Licenciada en Contabilidad, Postgrado en impuesto sobre la renta, diplomado auditoria interna, diplomado en norma internacionales de contabilidad, conocimiento del paquete informático, participación en mas de 50 cursos, talleres y seminarios, relacionados con la actividad profesional, dominio de impuestos sobre la renta, auditoria fiscal, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento y dominio ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley de sociedades), miembro activo instituto de Contadores Públicos Autorizados dela Republica Dominicana.

.

Licda. Melida Corniel

Supervisora Departamento de Impuestos

13 años de experiencia profesional, graduada en la carrera de Licenciatura en contabilidad en la Universidad Autónoma de Santo domingo (UASD).

Dominio de Impuesto sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley sociedad, conocimiento ley seguridad social, dominio de paquete informativo (Office).

Participación en varios cursos, seminarios y talleres relacionados con la actividad profesional.

Miembro activo del instituto de contadores públicos autorizados de la república dominicana.

.

Licda. Rocio del Rosario Romano

Supervisora Departamento Impuestos

Profesional con 7 años de experiencia, graduada de la carrera de Licenciatura en Contabilidad con los honores de Magna Cum Laude, actualmente cursando maestría en Gerencia Financiera en la Universidad Autónoma de Santo Domingo (UASD). Diplomados en Administración de Finanzas Corporativas, Auditoria Interna, Gerencia Impuestos Corporativos, Gerencia en PyMEs, así como cursos y talleres, relacionados con la actividad profesional.

Dominio de impuestos sobre la renta, contabilidad impositiva y financiera, conocimiento de Ley 11-92 (código tributario), conocimiento Ley Laboral 16-92, conocimiento Ley Seguridad Social, conocimiento Ley 479-08 (Ley de Sociedades). Habilidad para trabajar en equipo y en ambiente de presión, comprometida a brindar un servicio con responsabilidad, cumpliendo con los estándares de calidad y ética profesional.

Licda. Bianca Pichardo

Supervisora Departamento Outsourcing

Más de 8 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad en la Universidad Autónoma de Santo Domingo (UASD).

Dominio de impuestos sobre la renta, habilidad para trabajar en equipo, enseñar mis conocimientos y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley sociedades), miembro activo instituto de Contadores Públicos Autorizados de la Republica Dominicana, dominio del paquete informático Office. Participación en más de 30 cursos, talleres y seminarios, relacionados con la actividad profesional, así como diplomado especializado en gestión del capital humano.

Srta. Kristy Brito

Auxiliar departamento Impuestos

5 años de experiencia profesional, estudiante de término de la carrera de Licenciatura en Contabilidad en la Universidad Autónoma de Santo Domingo (UASD).

Dominio de impuestos sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, domina el paquete informático Office y participación en varios cursos, talleres, relacionados con la actividad profesional.

Licda. Yonairys Herrera

Asistente Gerencia de Impuestos

7 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad y Auditoría en la Universidad Nacional Pedro Henríquez Ureña (UNPHU) con los honores de Magna Cum Laude.

Dominio de impuestos sobre la renta, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, miembro activo en el instituto de Contadores Públicos y Autorizados de la República Dominicana, dominio del paquete informático Office y el idioma inglés. Participación en varios cursos, talleres, seminarios y diplomados, relacionados con la actividad profesional.

Disposición para el trabajo en equipo, capacidad para el trabajo bajo presión, responsabilidad y compromiso social, actualización de manera continua, calidad en el servicio y conocimiento y aplicación de lo normado en el Código de Ética.

Srta. Madeline Santos De La Cruz

Auxiliar departamento de Impuestos

6 años de experiencia profesional, estudiante de término de la Licenciatura en Contabilidad en la Universidad Autónoma de Santo Domingo (UASD).

Conocimiento del paquete informático, participación en más de 20 cursos, talleres y seminarios, relacionados con la actividad profesional, dominio de impuestos sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, conocimiento de contabilidad impositiva y financiera, conocimiento y dominio ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley de sociedades).

Licda. Chanely Hernández Severino

Auxiliar Departamento Outsourcing

Graduada de la carrera de Licenciatura en Contabilidad en la Universidad Católica Nordestana (UCNE) con los honores de Summa Cum Laude, con 1 año y medio de experiencia profesional con el dominio de la contabilidad impositiva, conocimiento ley 11-92 (código tributario) y dominio de la tesorería de la seguridad social, dominio del paquete informático y el idioma inglés. Habilidad para trabajar en equipo. Participación en distintos cursos y talleres orientados a la contabilidad fiscal y financiera así como al manejo de la seguridad social.

Srta. Yennifer Alfonso De La Cruz

Auxiliar de Outsourcing

Estudiante de termino en Contabilidad en la Universidad Autónoma De Santo Domingo (UASD), Ha Participado en diferentes cursos y talleres relacionados con el área, tales como Auxiliar en contabilidad, Manejo de impuesto sobre la renta, Manejo de Comprobantes Fiscales, Contabilidad Computarizada, Manejo de Inventarios, Servicio al cliente, entre otros. 10 meses de Experiencia Profesional en la Firma domina el paquete informático Office, Contabilidad Impositiva, habilidad para trabajar en equipo y en ambiente de presión.

Sra. Dilianny Mena Taveras

Auxiliar de Impuestos

1 año de experiencia laboral en la Firma de Auditores y Asesores (MGI LT Accountant y Asociados).

Estudiante en termino en la carrera de contabilidad, en la Universidad Autónoma de Santo Domingo, recinto San francisco de Macorís.

He participado en 5 cursos y talleres, 3 de ellos impartidos en INFOTEP: Ética profesional, Supervisión Efectiva profesional y secretaria ejecutiva, contabilidad por iguala y gestión de crédito y cuenta por cobrar.

CONSULTORES

Licda. Dora Lina Alcántara

Consultora Gestión Humana

Más de 15 años de experiencia profesional en el área de Gestión Humana, desarrollando los diferentes subsistemas del departamento, siendo sus últimos 5 años como parte del equipo de consultores de MGI dominicana, en la parte de Gestión Humana. Licda. En Derecho con una Maestría en Recursos Humanos, diplomado en Compensación y Beneficios, Liderazgo y Supervisión, Derecho Laboral, Taller de Tss, Taller de Comunicación Efectiva, dominio de elaboración de nómina y de TSS y de la ley 16-92 (Código Laboral Dominicano)

Habilidad para trabajo en equipo y para desarrollar equipo de alto rendimiento, así como para liderar cambios organizacionales que contribuyan al crecimiento sostenido de las empresas de cara a las nuevas tendencias del mercado.

Experiencia en la elaboración de manual de proceso de Gestión Humana, descripción de puestos, creación de políticas propias del área, manual de inducción y reglamento interno.

Ing. Egnio Alexander Díaz Polanco

Consultor Desarrollo Organizacional

18 años de experiencia profesional, graduado de la carrera de Ingeniería Industrial en la Universidad Dominicana O&M, Maestría en Diseño, Gestión y Dirección de Proyectos con títulos de la Universidad Europea del Atlántico y la Universidad Internacional Iberoamericana (UNINI)

Experiencia en Gestión de proyecto y planeación estratégica.

Dominio de Manufactura esbelta, Gestión de procesos, Liderazgo estratégico, Desarrollo del Talento Humano, técnicas y manejo de personal, Cadena de abastecimiento, Organización & Métodos, Gestión hospitalaria, Diseño e implementación del sistema de gestión y Diseño y Formulación de parámetros para ERP.

Experiencia de gestión: Sub Director de planificación y conocimientos del Instituto Oncológico y de Especialidades del Nordeste. Director de los proyectos del Patronato Contra el cáncer del Nordeste. Junior Sponsorship Manager en los programas de desarrollo de World Vision República Dominicana en Villa Altagracia. Coordinador de Logística y Distribución de ADM Dominicana.

Licda. María Portes

Consultora Externa y Servicios de Outsourcing

Más de 10 años de experiencia en el campo de la contabilidad y la auditoría. Se graduó con honores Cum Laude en la Licenciatura de Contabilidad, en la Universidad Autónoma de Santo Domingo, 2013. También se ha capacitado en administración y gestión de negocios, recursos humanos y contabilidad tributaria, con más de 30 cursos y diplomados en el área. Actualmente trabaja como consultora externa y servicios de outsourcing contable dentro de la red de clientes de MGI dominicana, donde ofrece asesoría y orientación en materia de contabilidad, auditoría y tributación, así como facilitadora en entrenamientos de personal a nivel corporativo. Buen dominio de las leyes impositivas y de seguridad social. Miembro activo del Instituto de Contadores Públicos Autorizados de la República Dominicana (ICPARD).

Licdo. Rabel Bueno

Consultor Externo Auditoría

14 años de experiencia profesional en las áreas e auditoría e impuestos, graduado de la Licenciatura en Contabilidad con méritos a la excelencia Cum Laude en la Universidad Autónoma de Santo Domingo (UASD). Con maestría en Contabilidad Tributaria y estudios post-grado en Auditoria, con acreditación de Facilitador de la Formación Profesional del Instituto de Formación Técnico Profesional (Infotep).

Dominio de los procedimientos de impuestos como: Impuesto sobre la Renta, Impuesto sobre la Transferencia de Bienes Industrializados y Servicios, Impuesto a la Propiedad Inmobiliaria y otros. Habilidades de análisis e interpretación, trabajo en equipo, solución de conflictos y bajo situaciones de presión. Conocimiento en el manejo de hojas de cálculos, gestión presupuestaria y de costos, aspectos laborales, seguridad social, procesos administrativos y procedimientos para controles internos. Miembro activo del Instituto de Contadores Públicos de la Republica Dominicana (ICPARD).

Licda. Estephani Guzmán

Consultor Externo Auditoría

9 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad en la Universidad Tecnológica de Santiago (UTESA) con los honores de Magna Cum Laude, diplomados en; Tributación Corporativa, Auditoría Interna, Sistema de Gestión De Normas ISO 9001:2015 y 45001:2018 (Gestión de la calidad y Gestión de seguridad y salud en el trabajo respectivamente), Elaboración De Proyectos y Gestión De Talento Humano.

Dominio de gestión y documentación de procesos, gestión y auditorias de control interno, habilidad para trabajar en equipo, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley seguridad social, dominio del paquete de oficina de microsoft y el idioma inglés, participación en más de 15 cursos, talleres y seminarios, relacionados con la actividad profesional.

Representación e importación de líneas internacionales de primera calidad.

Licda. Claudia E. Ramírez Rosario

Consultor Externo Auditoría

Cuenta con 15 años de experiencia profesional, graduada de Licenciatura en Contabilidad en la Universidad Autónoma de Santo Domingo (UASD) con los honores de Cum Laude, con Especialidad en Contabilidad Impositiva en la Universidad Autónoma de Santo Domingo (UASD), con Diplomado en Normas Internacionales de Información Financiera (NIIF), conocimiento del paquete informático, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, actualizaciones por medio de participación en múltiples cursos, talleres, seminarios y charlas relacionado con la actividad profesional, conocimiento y dominio ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley de sociedades), miembro activo instituto de Contadores Públicos Autorizados dela República Dominicana.

DEPARTAMENTO ADMINISTRATIVO

Licda. Carla Mariel Rodríguez

Socia-Gerente Financiera

Más de 11 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad en la Universidad Católica Nordestana (UCNE) con los honores de Magna Cum Laude, maestría en Contabilidad Tributaria y post-grado en contabilidad de gestión en la Universidad Autónoma de Santo Domingo (UASD).

Dominio de impuestos sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley sociedades), miembro activo instituto de Contadores Públicos Autorizados de la Republica Dominicana, domina el paquete informático Office y el idioma ingles y conocimientos en seguridad social. Miembro de Rotary Internacional. Participación de seminarios y entrenamientos técnicos en diversos países del mundo, como son: Estados Unidos, México, Chile y Colombia.

Licda. Erika Pichardo

Encargada Contabilidad de la Firma

9 años de experiencia profesional, graduada de la carrera de Licenciatura en Contabilidad en la Universidad Autónoma de Santo Domingo (UASD) .Dominio de impuestos sobre la renta, habilidad para trabajar en equipo y en ambiente de presión, contabilidad impositiva y financiera, conocimiento ley 11-92 (código tributario), conocimiento ley laboral, conocimiento ley seguridad social, conocimiento ley 479-08 (ley sociedades), ,domina el paquete informático Office y el idioma inglés y Participación en diversos Diplomados, conferencias y talleres.

Sr. José Luis Paulino Berroa

Encargado Soporte Técnico.

13 años de experiencia en mantenimiento de hardware y software e instalación de redes, graduado como Técnico Profesional en Informática.

Manejador de las herramientas Ofimáticas.

Con conocimiento en Diseño Gráfico, Electrónica, Ingles Técnico y Contabilidad Impositiva.

Sra. Aida Salazar

Servicios Generales

10 años en la firma, destacándose en la amabilidad, calidad de servicio. Compañerismo y el mejor café.

Sr. Lewis Cross

Servicios Generales / Mensajería

2 años en la firma, donde estar dispuesto al servicio, el respeto y la honestidad son su carta de presentación.

Licda. Altagracia Mendoza Genao

Asistente de Gerencia

Graduada en Licenciatura en Mercadotecnia en la Universidad Autónoma de Santo Domingo. Posee 11 años de experiencia profesional, con desempeño en las áreas de gestión de Salud. Diplomado en Gestión Hospitalaria del TEP Centro de Tecnología y Educación Permanente de la Pontificia Universidad Católica Madre y Maestra ( PUCMM), Diplomado en Gestion Comercial, Posee la titulación en Facilitador de la Formación Profesional por INFOTEP . Experiencia en Ventas, atención al cliente, gestión de cobros. Manejo del paquete Office. Ingles básico. Manejo y gestión de redes sociales, manejo básico de programas de diseño.

Servicios

Ofrecemos servicios de consultoría, auditoría, impuestos, outsourcing, marketing y recursos humanos. Acompañamos al cliente en todo el proceso, ofreciendo un servicio integral con asesoramiento en todos los niveles de su empresa:

Auditorías

- Auditoría de Estados Financieros

- Revisión de Estados Financieros

- Auditorias de Gestión

- Auditoria impositiva

- Auditoria Forense

- Revisión Fiscal

- Proyecciones financieras

- Investigaciones de fraudes

Impuestos

- Preparación y cumplimiento de declaraciones juradas

- Estudios sobre precio de transferencia y DIOR

- Revisión de acuerdos de accionistas

- Revisión de créditos fiscales

- Análisis de inventario

- Representación ante la DGII

- Acuerdos de exenciones fiscales

- Impuesto de inmuebles

Asesoría financiera y administrativa

- Organización de negocios

- Acuerdos de compra/venta

- Fusiones y adquisiciones

- Financiamientos

- Valuación de negocios

- Planes de negocios

- Evaluación de rendimientos

- Asesoramiento en Procesos

Outsourcing

- Contabilidad

- Revisión e implementación de procedimientos contables

- Evaluaciones de controles internos

- Análisis de costos

- Estructuración organizacional

- Asesoramiento en recursos humanos

- Evaluación del Recurso Humano

Nuestros servicios se rigen por los más exigentes sistemas de control de calidad según parámetros internacionales.

OFICINAS

OFICINA PRINCIPAL

SAN FCO. DE MACORIS

Calle Salcedo, Esq. La cruz, Plaza Galería 56, 3er Nivel, San Francisco de Macorís, República Dominicana

Tel.: (809) 588-3903 / (809) 244-5599

Email: servicioalcliente@mgidominicana.com

SUCURSAL

SANTO DOMINGO

-Av. Gustavo Mejia Ricart esq. Virgilio García Ordoñez, Ensanche Julieta, Santo Domingo.

Tel.:(809)-567-3903 / (809)-567-5599

CONTACTO

Estamos en nuestras oficinas de lunes a viernes de 8:00 AM a 5:00 PM